Did you know that overindulging your child can be hazardous to your financial health – both in the short and long-terms? In the best case scenario, overindulging your child ends up being a frustrating experience that nickels-and-dimes you to death. In the worst case scenario, it can literally bankrupt you!

Lessons you hadn’t intended to teach

Have you fallen into a pattern of every time you take your

child on a shopping trip – HE HAS TO

HAVE SOMETHING? It doesn’t matter if you are going grocery shopping, shoe

shopping, clothes shopping, or a trip to the garden center – HE HAS TO HAVE SOMETHING! Of course retailers don’t make it

easy for parents. They put all of

that fun stuff right at 5-year-old eye level as you check out! But that’s their

plan.

If you don’t buy him something, he turns on a full throttle WWF SmackDown scale tantrum right there in front of God and everyone! So, you buy him off. You give him what he wants and slink out of the store in embarrassment. This reoccurring event is extremely frustrating to you, and it teaches your child a lesson you didn’t intend to teach: “The world is my oyster and mom and dad are my ATM.” Could a pattern like this, which starts in early childhood, bring on your financial ruin? Possibly - if the pattern is long-term and becomes ingrained.

$$ General Education 101

Fast forward thirteen years. Your son is now a freshman in college and you have just dropped him off at school. You cosigned on a credit card with a $5,000 spending limit for “emergencies only.” In no time at all he maxes the credit card limit and there was no emergency! Now you are on the hook for his tuition, board and room, and a credit card bill at 21 percent interest. Think this couldn’t happen? Look at the facts reported by Sandra Block in the USAToday. Note: these figures do not include bills students owe for tuition, board and room.

- The average credit card debt for college freshmen is $1533.

- The average credit card debt for college seniors is $3262.

- 4% of college freshmen have credit card debt over $7000.

- 31% of college seniors have credit card balances of $3000 - $7000.

Graduation Day Has Arrived

The happy day has finally arrived. The good news is he is a graduate from an outstanding university. The bad news is he has accumulated a huge debt! He not only owes money on his credit cards, he owes money on college loans he took out over the years it took him to graduate and they will be coming due very soon.

According to Blake Ellis (CNN Money) "The bulk of the class of 2013's debt is in government loans, with graduates owing an average of $26,000. They also had an average of $19,000 in private loans, $18,000 in state loans, $13,000 in personal and family loans and $3,000 in credit card debt”.

Fast forward another fifteen years.

Your son has graduated from college, is married and is a young professional with an excellent job. Together he and his wife earn six-figures. They spend every nickel they make. They would like to buy a nice home, but don’t have the down payment, so you float them a loan with the understanding that they will pay you back with interest, and it never happens. Jeff Opdyke who writes the Love & Money column for the Wall Street Journal wrote a piece titled “Is It Time to Cut the Financial Cord?” and in it he cited numerous cases just like this. These children rationalized their behavior by saying they were collecting their inheritance early.

Old patterns die hard, but they can change. Now is the time to start teaching your child that “The world may be his oyster, but mom and dad are not his ATM.”

Tips for avoiding overindulgence

- Set limits and enforce them.

- Teach your children to do chores.

- Talk about money management with your children. I suggest Nathan Dungan’s Share Save Spend techniques as a guide: www.sharesavespend.com.

- Teach the difference between wants and needs.

- Role model good money management.

- Learn to say no.

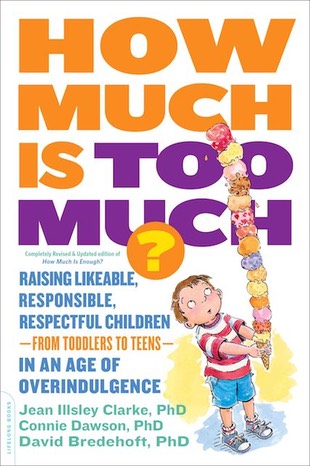

There is more help about avoiding overindulgence in How Much is Too Much? Raising Likeable, Responsible, Respectful Children – From Toddlers To Teens – In An Age of Overindulgence (2014, DaCapo Press Lifelong Books).

All photos from MorgueFile free photo.